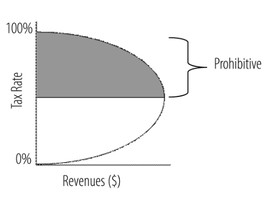

By Johnathan Li ’24Following former U.K. prime minister Liz Truss’ turbulent time in office, the term “trickle-down economics” has returned to public political discourse. Critics attributed this term to her massive tax cuts associated with chancellor Kwasi Kwarteng’s Growth Plan of 2022. Trickle-down economics is a critical term given to the ideas, often based on supply-side economics which focuses on maneuvering aggregate supply as opposed to aggregate demand, that promotes tax reduction, especially for the upper-income class. The wealth created by these reductions would then in turn, through expenditure and investment, “trickle-down” the economic ladder. The Growth Plan decreased both the base income tax rate to 19% and abolished the 45% rate of income tax for earnings over £150,000; these measures were criticized for disproportionately benefitting the wealthier taxpayers. However, while the Growth Plan was meant to promote economic growth, it has been detrimental to the UK economy, further exacerbated by massive bond sellouts related to concerns about the economy. Proponents of similar theories to trickle-down economics refer to the Laffer Curve, which graphs the relationship between tax rates and tax revenues. The “prohibitive range” of the graph illustrates a phase where the decrease in the tax rate would theoretically lead to an increase in government revenues. It is theorized that the increase in spending power as a result of the decrease in the tax rate would encourage economic growth, which boosts tax revenue. Laffer Curve Economic growth can be achieved conditionally to the extent that these lower tax rates can lead to behavioral changes by investors to increase the aggregate output of the economy. There have been historical cases, such as the end of the Wilson administration, where high tax rates meant for postwar reparations discouraged investors from investing in private industries; instead, they placed their investments into tax-exempt securities. Under such circumstances, a decision to lower tax rates would facilitate growth, increasing both taxable income and investment in the market, simultaneously increasing government revenue and economic activity. This illustrates a case where lowering tax rates can facilitate growth, given that the previously higher rates inhibited growth-spurring investments.

However, the tax cuts in the context of Truss and Kwarteng served only as a fiscal policy. The funding for these tax cuts did not come from the resulting revenue but through increasing the government deficit. Their emphasis on reducing the tax rates of the rich suggests that they believe the wealthy investors would supply employment and promote private businesses, “trickling down” their income to the remaining population. However, since the higher-income investors had no incentives to productively utilize the extra income in promoting industries, there was no such phenomenon. Wealth did not trickle down because the increased purchasing power of the wealthier investors did not necessarily equate to higher purchasing activity in the economy at large. Instead, the Keynesian demand-side model would advocate for a tax reduction that does not disproportionately benefit the wealthy, as the middle and lower classes are much more likely to increase expenditure and create economic growth. Bibliography Amadeo, Kimberly. 2021. “Why Trickle-Down Economics Works in Theory But Not in Fact.” The Balance. Dec. 30, 2021. https://www.thebalancemoney.com/trickle-down-economics-theory-effect-does-it-work-3305572 BBC News. 2022. “What Was in the Mini-Budget and What Is the Government’s New Plan?,” Sept. 21, 2022, sec. Business. https://www.bbc.com/news/business-62920969 Easton, Joe. 2022. “‘Uninvestable’ UK Market Lost £300 Billion in Truss’s First Month.” Bloomberg.Com, Oct. 6, 2022. https://www.bloomberg.com/news/articles/2022-10-06/-uninvestable-uk-market-lost-300-billion-in-truss-first-month Keegan, William. 2022. “Have Liz Truss’s 44 Days in Office Destroyed 40 Years of Free Market Philosophy?” The Observer, Oct. 23, 2022, sec. Opinion. https://www.theguardian.com/commentisfree/2022/oct/23/liz-truss-kwasi-kwarteng-free-market-philosophy Sowell, Thomas. 2013. “Trickle Down Theory” and “Tax Cuts for the Rich.” Hoover Press Comments are closed.

|

Photos from Verde River, Manu_H, focusonmore.com, Brett Spangler, Cloud Income